Renters Insurance in and around Springfield

Looking for renters insurance in Springfield?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

There’s No Place Like Home

Home is home even if you are leasing it. And whether it's a townhome or an apartment, protection for your personal belongings is beneficial, especially if you own items that would be difficult to fix or replace.

Looking for renters insurance in Springfield?

Rent wisely with insurance from State Farm

Open The Door To Renters Insurance With State Farm

It's likely that your landlord's insurance only covers the structure of the home or townhome you're renting. So, if you want to protect your valuables - such as a guitar, a smartphone or a tool set - renters insurance is what you're looking for. State Farm agent Angel Rodriguez is dedicated to helping you evaluate your risks and insure your precious valuables.

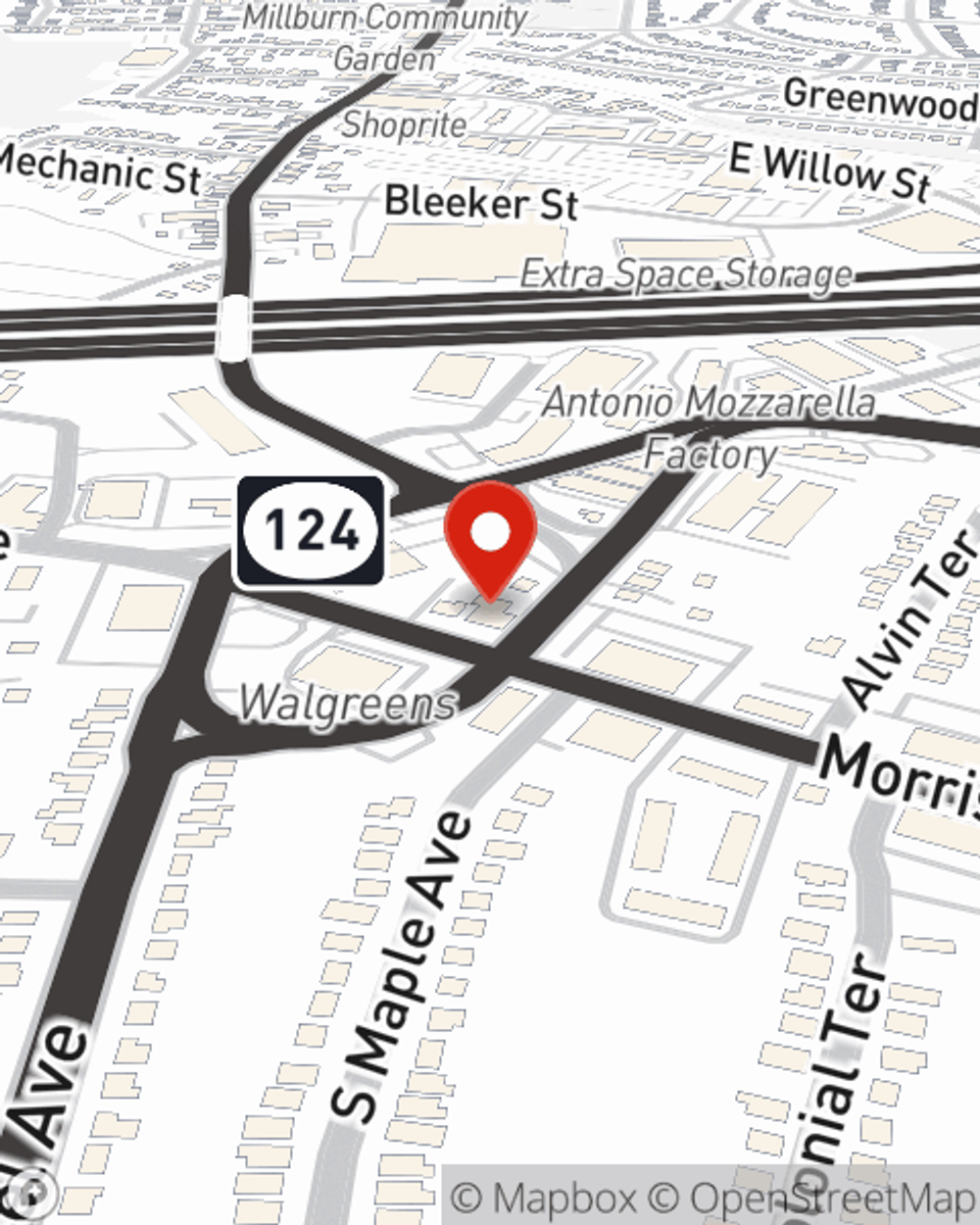

Reach out to Angel Rodriguez's office to discover how you can benefit from State Farm's renters insurance to help keep your personal property protected.

Have More Questions About Renters Insurance?

Call Angel at (973) 232-6170 or visit our FAQ page.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Angel Rodriguez

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.